Adalah dimaklumkan bahawa Portal MyGST ini tidak lagi dikemaskini semenjak GST dimansuhkan pada 31 Ogos 2018. Payment of SST Sales and Service Tax.

The Goods and Services Tax is an abolished value-added tax in Malaysia.

. SST is administered by the Royal Malaysian Customs Department RMCD. The existing standard rate for GST effective from 1 April 2015 is 6. IRB Agents Telebanking.

Sehubungan dengan itu sebarang pertanyaan dan maklumat lanjut berkaitan GST sila hubungi Pusat Panggilan Kastam 1-300-888-500 atau emailkan ke ccccustomsgovmy. The payment can be made by bank draftcheque in the name of Ketua Pengarah Kastam Malaysia. You pay RM1590 including the current Service Tax of 6.

For the second reduced VAT rate 5 multiply the original price by 105. Payment of individual Income Tax and Real Property Gain tax RPGT can be made via tele-banking service at Maybank Kawanku Phone Banking 1-300-88-6688 6. Many domestically consumed items such as fresh.

Your business name and address. What is GST rate in Malaysia. On April 01 2015 goods and services tax GST was introduced in AustraliaAll transactions after this affective date are to follow GST norms.

What is the GST treatment. GST is scheduled to be implemented on 1st April 2014 in Singapore. It can be used as well to reverse calculate Goods and Services tax calculator.

Deposit part payment for the supply of goods services has been paid before 01 June 2018 and goods services are supplied after 01 June 2018. Malaysia reintroduced its sales and service tax SST indirect sales tax from 1 September 2018. Collecting GST in Malaysia.

How to work out SST in Malaysia. Payment via chequebank draftmoney order must be made payable to Ketua Pengarah Kastam Malaysia and mail to. Payment of individual Income Tax and Real Property Gain tax RPGT can be made via Auto Teller Machine ATM at Public Bank Maybank and CIMB Bank.

GST was only introduced in April 2015. Malaysian Goods and Services Tax GST is similar to Valued Added Tax VAT in other countries and is a new form of tax in Malaysia. Individual or business customers of the Bank to claim back the GST amount from the Royal Malaysian Customs Customs.

Any business with a yearly turnover in excess. If the total amount of claim exceeds RM300 ie the total GST you are claiming spread out over all purchases all above RM300 in a single receipt payment can be done to your credit card. How does GST work in Malaysia.

Obtain a copy of the GST TAP website and click the Register for GST hyperlink. The GST office can be found at the Arrivals Hall in KLIA Kuala Lumpur. In Malaysia the goods and services tax GST was introduced on April 1 2015.

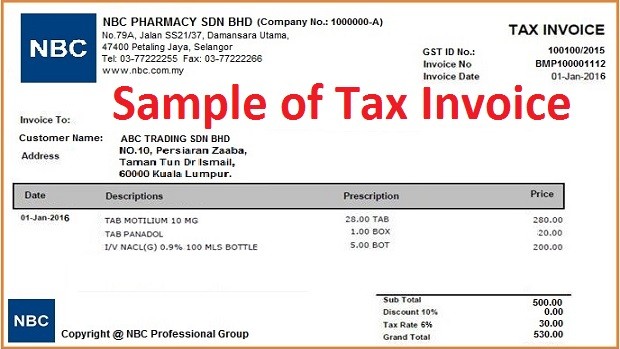

Your business VAT number. Ketua Pengarah Kastam Malaysia Jabatan Kastam Diraja Malaysia Pusat Pemprosesan GST Kompleks Kastam Kelana Jaya No22 Jalan SS63 Kelana Jaya 47301 Petaling Jaya Selangor. KUALA LUMPUR June 15 The Finance Ministry through the Royal Malaysian Customs Department is committed to ensuring that the Goods and Services Tax GST refund to taxpayers will be expedited and payment to be made beginning June 22.

The fixed rate is 6 and some types of goods and services can be exempt from this tax while others are taxed at different rates. Goods and Services Tax GST Malaysia will be implemented with effective from 1 April 2015 and GST rate is fixed at 6 per cent. Segala maklumat sedia ada adalah untuk rujukan sahaja.

VAT in Malaysia known as Sales and Service Tax SST was introduced on September 1 2018 in order to replace GST Goods and Services Tax. Minister Tengku Datuk Seri Zafrul Abdul Aziz said the payment process would be completed by December this year. Any person who makes a taxable supply for business purposes and whose taxable turnover exceeds the RM500000 level is required to register for.

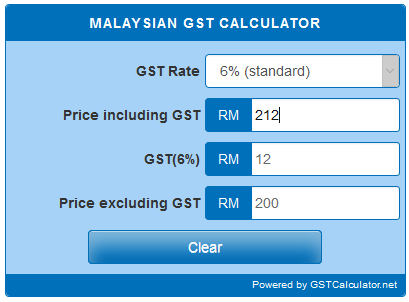

Then click on the Next button to go to the next stage. 300 is GST exclusive value 300 006 18 GST amount To get GST inclusive amount multiply GST exclusive value by 106. Goods and Services are currently taxed at a GST Rate of 6.

For the first reduced SST rate 6 multiply the original price by 106. VAT Registration in Malaysia. Jabatan Kastam Diraja Malaysia Pusat Pemprosesan Kastam Kompleks Kastam Kelana Jaya No22Jalan SS63 Kelana Jaya 47301 Petaling Jaya Selangor.

Part payment is subject to GST on the standard rate of 6 while the balance of payment if made after 01 June 2018 is subject to standard rate of 0. In the current tax regime the 10 Sales Tax on manufacturing and imports and 6 Service Tax on the FB and professional services industry is collected by one party usually the seller and passed on to the tax authorities. Total price excluding GST.

Ketua Pengarah Kastam Jabatan Kastam Diraja Malaysia Pusat Pemprosesan GST Kompleks Kastam Kelana Jaya No22 Jalan SS63 Kelana Jaya 47301 Petaling Jaya Selangor. It replaced the 6 Goods and Services Tax GST consumption tax which was suspended on 1 June 2018. The Royal Malaysian Customs Department RMC or known also as Jabatan Kastam Diraja Malaysia acts as the agent of the Malaysian government and.

Select the type of business you want to run. The address to is as follows. Just multiple your GST exclusive amount by 006.

Submit GST return GST-03 and pay tax not later than last day of following month after taxable period Issue tax invoice on any supply unless as allowed by Customs Inform Customs of the cessation of business within 30 days from the date of business cessation. Do I need to register for GST in Malaysia. Payment via chequebank draftmoney order must be made payable to Ketua Pengarah Kastam and mail to.

Once youre registered for taxes youre expected to charge 6 GST on every sale to a Malaysian resident. GST invoices in Malaysia. Total price including GST To work out the total price at the standard rate of SST 10 multiply the original price by 11.

If you claim less than RM300 that payment is in cash. After receiving your cash you can head over to an exchange office. GST is levied on most transactions in the production process but is refunded with exception of Blocked Input Tax to all parties in the chain of production other than the final consumer.

When was GST introduced in Malaysia. In order to comply with tax laws you should include the following information on your invoices to customers in Malaysia. How to calculate Malaysian GST manually To calculate Malaysian GST at 6 rate is very easy.

Starbucks will keep RM15. The valid tax invoice is issued by the Bank in the name of the individual or business customer and contains the information required under the GST regulations.

Difference Between Sst Gst Sst Vs Gst In Malaysia 2020 Updated

Countries Implementing Gst Or Vat

Gst Vs Sst In Malaysia Mypf My

Gst Rates In Malaysia Explained Wise

How To Work Out Your Gst Return Gst Bas Guide Xero Au

Difference Between Sst Gst Sst Vs Gst In Malaysia 2020 Updated

How To Start Gst Get Your Company Ready With Gst

How To Start Gst Get Your Company Ready With Gst

Sales And Service Tax Sst In Malaysia Transitional From Gst To Sst 2 0

Malaysia Goods And Services Tax Gst Penalties Goods Services Tax Gst Malaysia Nbc Group

Gst Vs Sst In Malaysia Mypf My

Malaysian Gst Calculator Gstcalculator Net

Malaysia Sst Sales And Service Tax A Complete Guide

How To Start Gst Get Your Company Ready With Gst

Implementation Of Goods And Service Tax Gst In Malaysia Yyc